Investor Pitch Practice for Bootstrapped Founders Raising First Round

Master investor pitch practice for bootstrapped founders raising first round. Transitioning from bootstrapped to funded is challenging—bootstrapped companies face unique scrutiny from VCs about why they're raising now. Get the investor pitch practice you need to confidently navigate your first fundraising experience and secure capital to scale your proven business model.

Why Investor Pitch Practice for Bootstrapped Founders Raising First Round Works

Risk-Free Practice Environment

Investor pitch practice for bootstrapped founders raising first round provides a safe space to practice without risking real investor relationships. Make mistakes, refine your story, and build confidence before approaching actual VCs.

Practice Anytime, Anywhere

As a bootstrapped founder juggling operations and fundraising, investor pitch practice for bootstrapped founders raising first round is available 24/7. Get instant feedback without waiting for mentor availability.

Bootstrap-to-Funded Expertise

Our investor pitch practice for bootstrapped founders raising first round understands unique challenges. Bootstrapped companies need to clearly articulate their transition strategy. Get questions about profitability, customer acquisition costs, and why you're raising now.

Proven Fundraising Success

Bootstrapped founders using investor pitch practice for bootstrapped founders raising first round report 3x more confidence in investor meetings and significantly better preparation for due diligence questions.

How Investor Pitch Practice for Bootstrapped Founders Raising First Round Transforms Your Fundraising

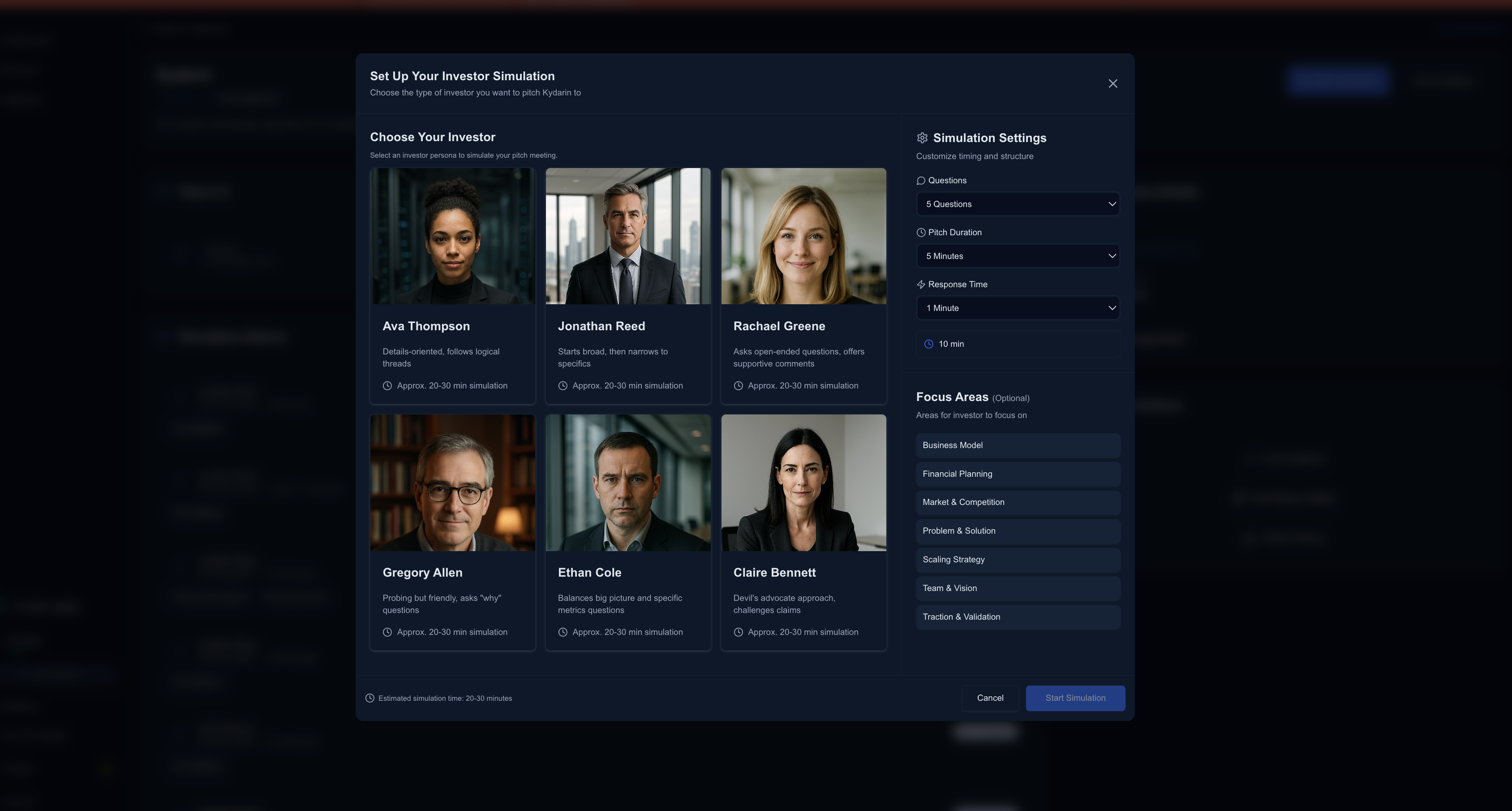

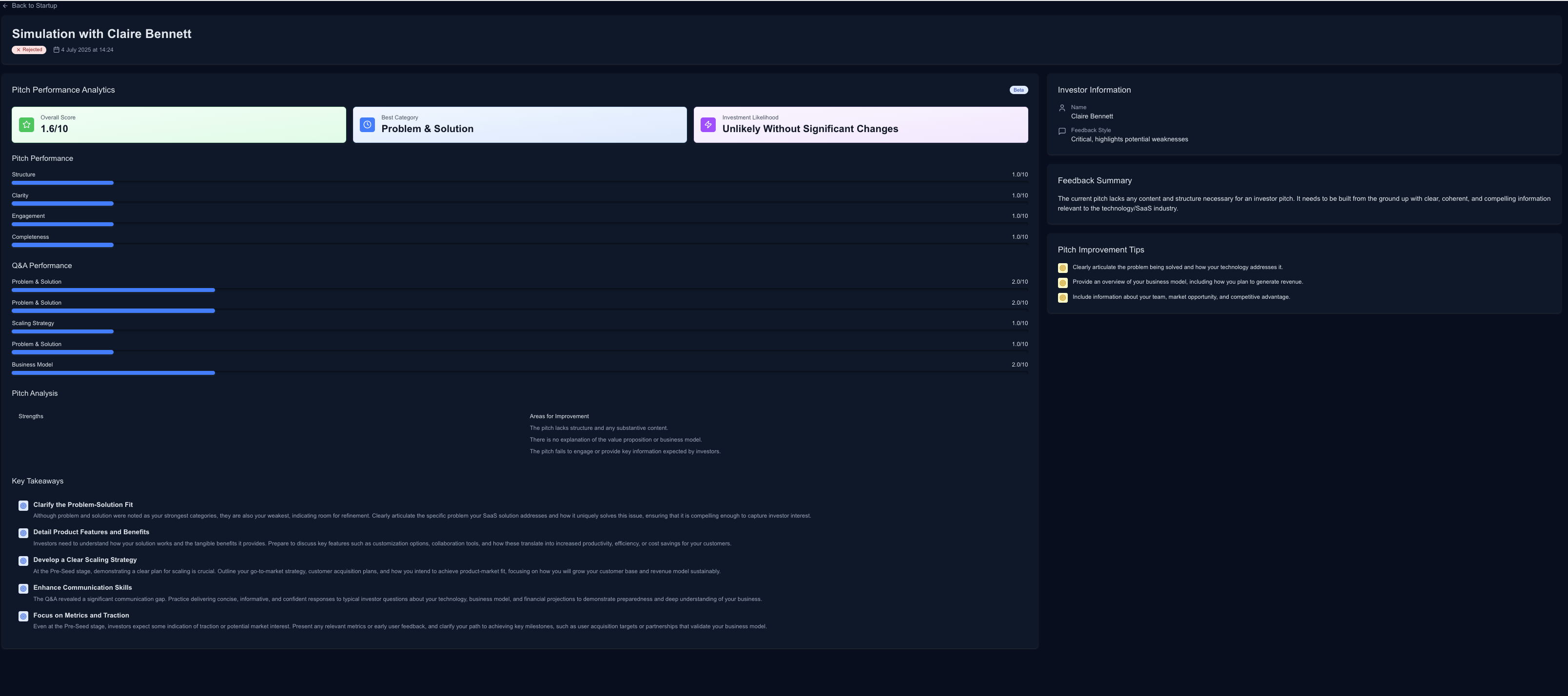

Select Your First-Round Investor Type

Choose from angel investors, micro-VCs, or seed funds that typically invest in bootstrapped companies raising their first institutional round. Each investor type has different expectations and questions for first-time fundraisers.

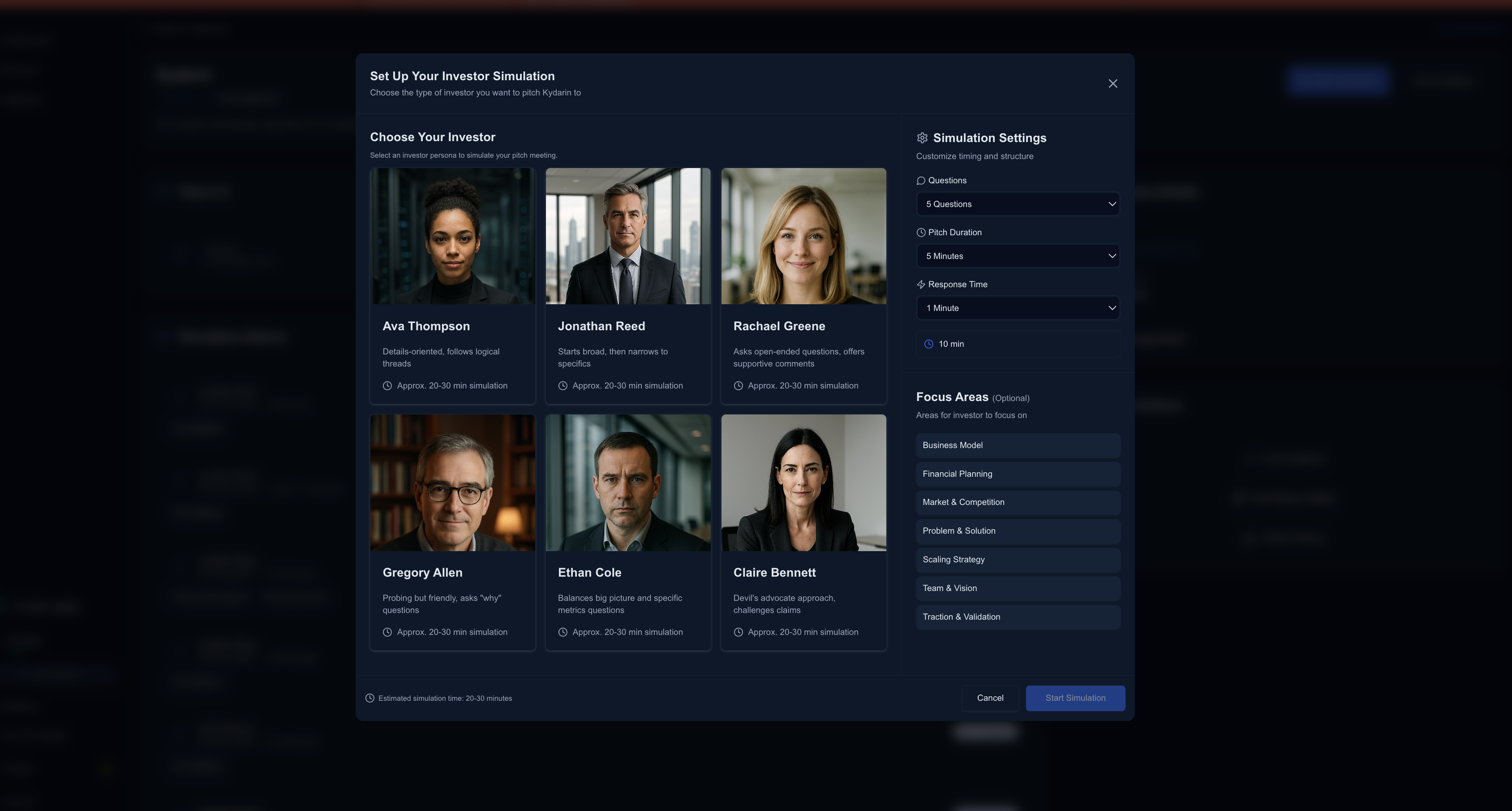

Practice Your Bootstrap-to-Funded Story

Engage in realistic investor pitch practice for bootstrapped founders raising first round. Present your traction, explain why you're raising now, and articulate your growth plan. The AI investor asks tough questions about profitability and scaling strategy.

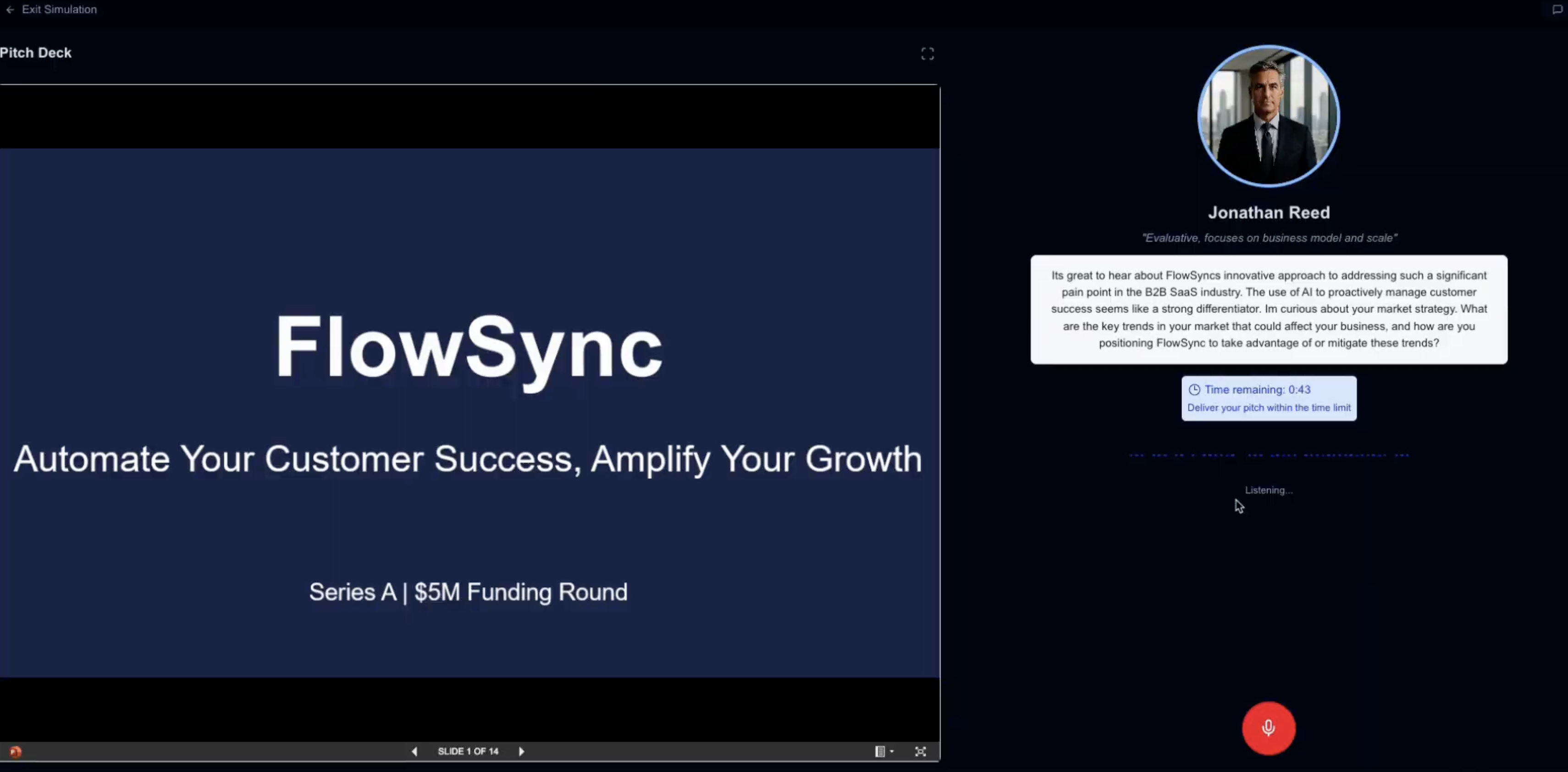

Review Your Performance Metrics

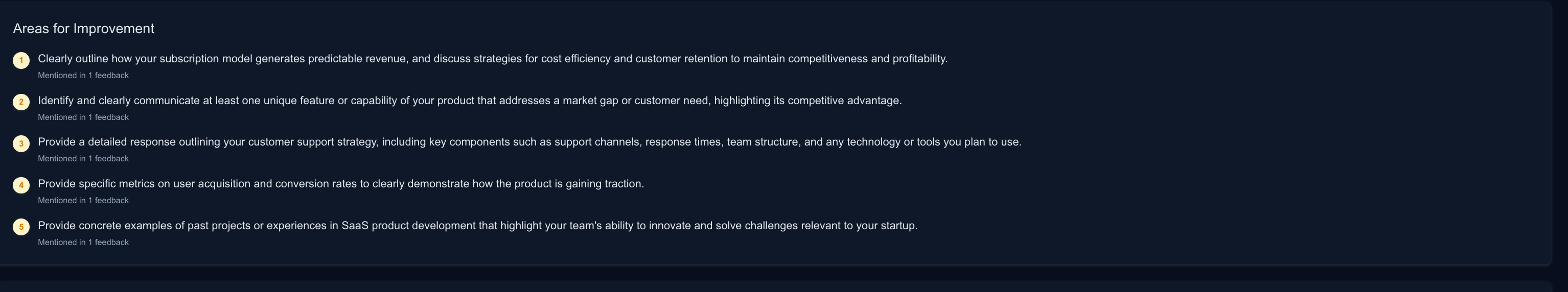

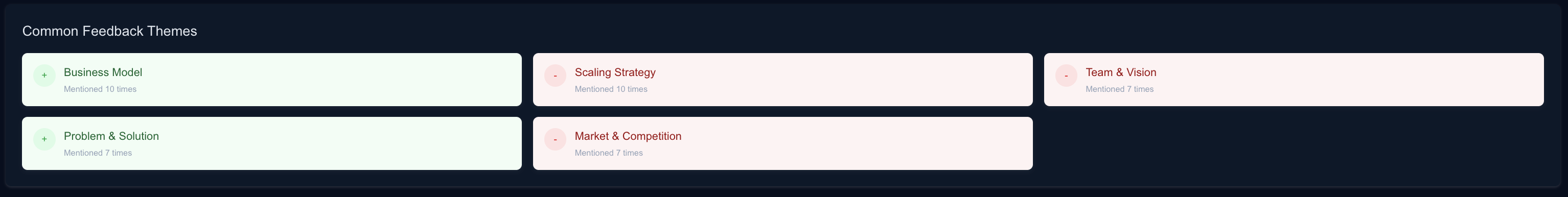

After each session, get detailed scores on pitch clarity, financial storytelling, and confidence. See exactly where you excelled and where you need more practice before your real first-round investor meetings.

Get Actionable Feedback

Receive specific recommendations on improving your pitch for bootstrapped founders raising their first round. Learn how to better articulate your unit economics, customer acquisition strategy, and why now is the right time to raise institutional capital.

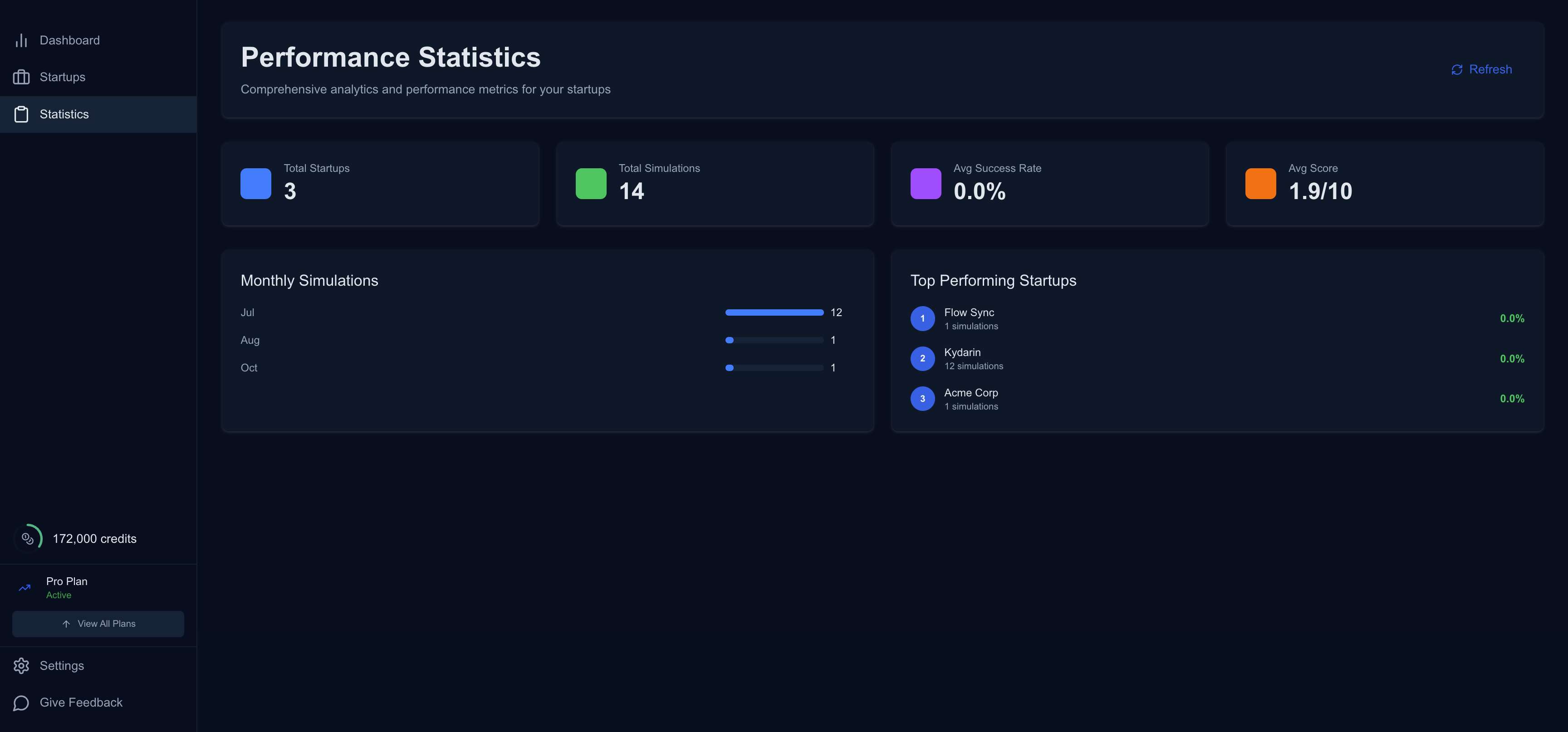

Track Your Progress to Funding

Monitor your improvement across multiple practice sessions. Watch your confidence and pitch quality increase as you prepare for your first institutional fundraising round. See trends in your performance and identify remaining weak spots.

Master Critical Questions with Investor Pitch Practice for Bootstrapped Founders Raising First Round

Bootstrapped founders face unique questions when raising their first institutional round. Proven traction gives bootstrapped founders leverage, but only if articulated effectively. Investor pitch practice for bootstrapped founders raising first round helps you handle these critical investor concerns.

Why Raise Now?

Practice articulating why you're transitioning from bootstrapped to funded and what you'll accomplish with institutional capital.

Unit Economics Deep Dive

Defend your CAC, LTV, payback period, and margins with confidence—investors will scrutinize your fundamentals closely.

Team Building Plans

Explain how you'll use funding to build a team when you've been running lean, and which roles are most critical first.

Profitability vs. Growth

Navigate questions about sacrificing profitability for growth and how you'll manage burn rate after being cash-flow positive.

Traction Validation

Present your bootstrapped traction compellingly—revenue, customers, growth rate, and product-market fit indicators.

Scaling Strategy

Articulate how you'll scale operations, marketing, and sales with institutional funding after bootstrapping to this point.

Competitive Positioning

Explain your competitive advantages and why you've succeeded bootstrapped while others raised millions.

Runway and Milestones

Define clear milestones you'll hit with the funding and how long the capital will last based on your planned burn rate.

Bootstrapped Founders Trust Investor Pitch Practice for Bootstrapped Founders Raising First Round

"As a bootstrapped founder, I had zero experience pitching to VCs. Investor pitch practice for bootstrapped founders raising first round helped me understand what investors actually care about. I practiced handling questions about why I was raising now and my unit economics until I felt confident. That preparation was crucial for closing my seed round."

Start Investor Pitch Practice for Bootstrapped Founders Raising First Round Today

Join bootstrapped founders using investor pitch practice for bootstrapped founders raising first round to confidently transition from self-funded to institutional capital. Start practicing today and close your first round.